Vansh Bhatnagar

Aug 21, 2025

Key Highlights

An independent contractor agreement helps a business owner and a freelancer. It sets the scope of work, how the worker will be paid, and sets up deadlines. This way, both people know what to do, and there are no fights later about the job.

The contract says the person is an independent contractor, not an employee. This is needed for legal compliance with the IRS, so there is no mix-up about their roles.

You will also see important clauses in the agreement. These cover confidentiality, rules about intellectual property, and the payment terms. These help protect both sides in the deal.

If you add in a termination clause and a way to handle fights or issues, ending or renewing the job goes more smoothly.

Following jurisdictional laws and staying up to date with rules is key. This keeps you from having any trouble with penalties for tax and classification mistakes.

Every successful business owner needs to know why it is important to have an independent contractor agreement when they hire a freelancer or contractor. This written agreement builds a clear and helpful working relationship. It makes sure that things like payment schedules, intellectual property rights, and confidentiality are covered.

These agreements also make the contractor's classification as independent very clear. This helps both people know their job and avoid any mix-ups. In the end, a contractor agreement lets both sides work well and safely in a clear independent contractor relationship.

Understanding Independent Contractor Agreements

An independent contractor agreement is a formal contract made between a business and a freelancer or contractor. This agreement shows that the two parties do not have an employer-employee relationship. It explains the responsibilities that each side has. This helps support the classification as an independent contractor. The agreement also protects both sides from legal problems. These could include questions about tax or payment issues.

The agreement makes clear the contractor’s scope of work, how much they will get paid, and what deliverables are expected. With these details, the contractor agreement helps prevent misunderstandings. It also lets freelancers offer their specialised services while keeping their independent status.

Key Differences Between Contractors and Employees

Understanding the differences between independent contractors and full-time employees is fundamental to avoiding misclassification. The primary distinction lies in the level of control exercised by the hiring company. Independent contractors manage their own schedules, use their own tools, and work on a project basis, while employees adhere to structured protocols dictated by the business.

The IRS identifies workers based on three criteria: Behavioral (degree of control), Financial (payment terms), and Relationship (duration and benefits). For instance, employees receive Social Security benefits, whereas contractors handle their own contributions.

Aspect | Employees | Independent Contractors |

|---|---|---|

Degree of Control | High; company provides clear instructions | Minimal; the contractor has autonomy |

Tools Provided | The employer provides tools and equipment | Contractor uses their personal tools |

Tax Responsibility | The employer manages taxes | Contractor pays their own taxes |

Relationship Duration | Ongoing | Defined by the specific project scope |

By addressing these points, businesses can confidently classify workers while staying compliant with IRS and state guidelines.

Related Article: NDAs (Non-Disclosure Agreements): A guide to secrecy

Importance of an Independent Contractor Agreement

Having a solid independent contractor agreement is key if you want to protect your business and make sure you follow the law when hiring someone as a contractor. It helps by giving clarity on payment terms, what work should be delivered, and who will own the intellectual property made during the job. This can lower the chances of problems or arguments.

This contract is different from an employment agreement, because the contractor agreement clearly says the worker is independent. That helps keep the business safe from mistakes if their status is checked. By setting these rules early, both sides can work with clarity. The contractor and the company know what to do, which helps build trust and keeps both people responsible for their part.

Protecting Business Interests and Legal Compliance

An independent contractor agreement is very important for protecting a business from legal and money troubles. It has contractual obligations that show what each side must do. This helps stop fights about work or payment. For example, if there is an indemnification clause, the contractor will take care of losses if they do something wrong.

The agreement also makes clear that the person is an independent contractor and not an employee. This shows the Internal Revenue Service and other government agencies that both sides agree. Keeping this clear can help stop fines or reviews for worker misclassification.

The agreement also helps keep business secrets safe and protects intellectual property. It covers confidentiality and who owns what. If done well, a strong contractor agreement gives clarity, meets the contract law, and keeps your business secure. This makes working together easy and avoids trouble for both people.

Setting Clear Expectations and Deliverables

To avoid problems, an independent contractor agreement should set clear expectations about what tasks or results are needed, and when they should be done. The scope of work for the project should be described in detail. This lets the contractor and client be sure they want the same thing, so there are no surprises or unclear points that get in the way.

This part of the agreement also talks about what level of quality is needed and when each milestone should be finished. Often, this will be tied to a date or how well the work is done. For example, by saying what the deliverables are—such as software designs or graphic files—both sides can point to something real as proof that the work is done.

When there is no space for misunderstandings, the business will face fewer delays, and there will be less escalations. This helps the contractor know exactly what to do and when to do it. Making timelines, quality, insurance requirements, and who’s counting on what very clear lets people do the work better when using a contractor agreement.

Related Article: NDAs (Non-Disclosure Agreements): A guide to secrecy

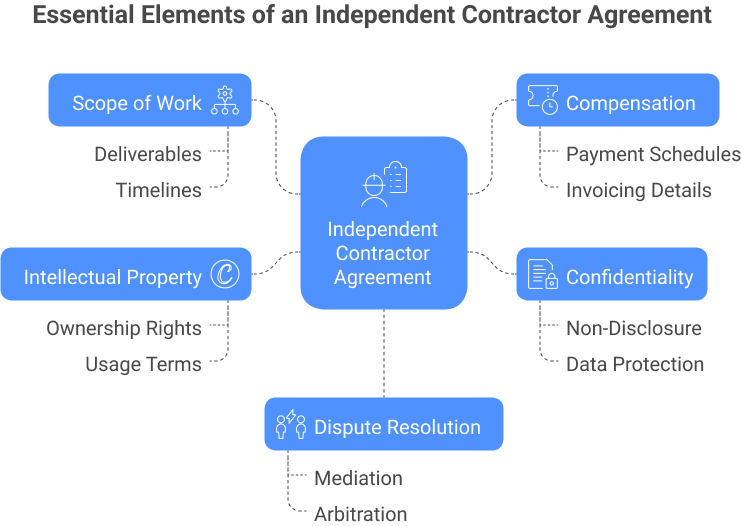

Essential Elements of an Independent Contractor Agreement

A good independent contractor agreement has important parts that help keep both parties safe from problems. It also explains how they will work together. Important pieces like the scope of work, how and when to pay, and confidentiality clauses help with many of the issues that can come up between a contractor and a company.

The contractor agreement should also have other parts, like an indemnification clause, rules about who owns the intellectual property, and ways to solve disagreements. These protect the business in many different situations. When you clearly write out all these rules, the written agreement gives everyone a strong base for handling what needs to be done and settling any issues. This way, you can deal with problems without hurting your trust or breaking your contractual obligations.

Scope of Work and Project Specifications

The scope of work part is a key part of an independent contractor agreement. This part explains the description of the services that the contractor will give. It also lists out the main tasks, dates, and milestones. This helps the hiring company and the contractor stay on the same page.

For example, think of a graphic designer working as an independent contractor. The agreement can say what the deliverables are, like logo designs, mock-ups, or other branding assets. When you add how long the work should take, it shows when each thing needs to be done. This helps with getting things done on time and making sure everyone does what they say. If you set clear steps and tasks, it makes fights and delays less likely.

If you adjust this part to fit the right project specifications, it keeps things clear. There will be less confusion, and both the hiring company and the independent contractor know what to expect right from the start. Next, we will talk about compensation and payment ways in the contractor agreement.

Compensation, Invoicing, and Payment Terms

A well-defined compensation clause helps bring clarity to payment schedules and how invoicing should be done. This part says if the contractor will get an hourly rate, a flat fee, or money only when the work is done.

Key things to add are:

Easy-to-understand payment schedules, like monthly or based on when work is finished.

Details on invoicing, like when to send and process invoices.

Payment terms, which can be bank transfers, checks, or PayPal.

Penalty clauses if payment is late or the work does not meet what was agreed.

This clarity gives both people trust. It makes sure that both sides know their payment duties. A clear written agreement is important, because it helps avoid payment problems and helps with compliance later.

Would you like to know how confidentiality plays a part in these contracts? Let's go to the next section.

Related Article: MSA Agreements: Your Guide to Master Service Agreement

Confidentiality, Non-Disclosure, and Data Protection

Keeping confidential information safe in an independent contractor agreement is very important. It helps protect a business’s own data and trade secrets. Clear clauses about non-disclosure and data safety make sure that any contractor knows to keep it all private. This means trade secrets and all other important information are not shared without care.

Sometimes, an agreement may say that you must get prior written consent before you can give out some business details to someone outside. This part of the contract is legally binding. It helps protect companies from contract data leaks and makes it clear to contractors how to deal with sensitive data. This gives both the business and the contractor a good sense of their formal contractual obligations, which is key to trust and clarity in the work.

Confidentiality Clauses and NDAs Explained

Confidentiality clauses and Non-Disclosure Agreements (NDAs) are important tools the workplace uses to keep confidential information and trade secrets safe. A confidentiality clause tells the service provider that they must not share any proprietary information they get while doing their work. This helps make sure that these secrets do not get out.

NDAs go a bit further. They bind both parties, by law, not to share details about the project or any confidential information involved. These agreements help people trust each other and set clear expectations from the start. Having such clauses in place can prevent people from breaking the deal and sharing things they should keep private.

Handling Sensitive Information and Trade Secrets

A good independent contractor agreement should talk about how you both handle confidential information and trade secrets. You need to have a confidentiality clause so that both sides know how important these private things are. It is good to add clear meanings of what confidential information is to stop problems if something private gets out.

When you use a service provider, you should think about adding an indemnification clause. This clause helps protect you if there is a leak. Make sure to keep your contractor agreement updated when the relationship or the scope of work changes. This will show that you and the other person are serious about keeping trade secrets and confidential information safe.

Related Article: What is Service Level Agreement? Your Ultimate Guide

Intellectual Property Rights and Ownership

Intellectual property rights help keep new ideas and works safe when people or businesses work together. In an independent contractor agreement, it is very important to state who owns the intellectual property. This helps to keep away any misunderstandings. The agreement should also talk about who gets to keep rights over deliverables and proprietary information.

It is a good idea to say in the contractor agreement exactly how trademarks, copyrights, and patents will be handled. This way, the service provider and the hiring company both know what their rights are. When you set up these rules from the start, it helps everyone know what to expect, which can stop so many problems over who owns or can use the intellectual property later on.

Assignment of Work Product and IP Ownership

It is important for the hiring company and the service provider to be clear about who owns the work and intellectual property made during the job. In the independent contractor agreement, this part says who will keep the rights to the deliverables from the project. Many times, the business owner will have these rights unless the contract says something else.

The contractor agreement should also have an indemnification clause. This clause will help protect the people involved if there are problems and make sure all proprietary information stays safe. Having a clear agreement gives clarity, helps both sides know what to expect, and can stop disagreements about intellectual property in the future when they work together again.

Addressing Copyrights, Trademarks, and Patents

Knowing how to deal with copyrights, trademarks, and patents is important for a service provider who wants to protect their intellectual property. When you create an independent contractor agreement, you need to clearly lay out who owns what and who is responsible for different assets.

You should make it clear how trademarks can be used or registered. You also need to state who owns any work that gets made while the contractor agreement is active. This can protect against anything going sideways and helps all parties have clear expectations about the scope of work and what needs to be delivered.

Related Article: What is a Content Licensing Agreement? Comprehensive Guide

Term, Termination, and Dispute Resolution

Setting clear rules in an independent contractor agreement is very important. You need to include things about how long the agreement lasts and the ways it can end. These clauses help both the hiring company and the service provider know what to expect. If there is a problem, using dispute resolution like arbitration or mediation can avoid legal action.

By laying out these guidelines, both sides get clarity. This cuts down on misunderstandings and helps people stick to their contractual obligations. This way, the working relationship stays smooth.

Duration, Renewal, and Termination Clauses

Duration clauses in an independent contractor agreement say how long the agreement will last. These clauses set clear expectations for both the hiring company and the service provider. Sometimes, there can be renewal clauses. These let the services keep going without needing a new written agreement. This helps make sure the working relationship does not stop suddenly.

Termination clauses tell when and how either side can end the agreement. This gives protection to both the hiring company and the service provider if someone does not follow the agreement, which people often call a breach of contract. When you include all these types of clauses, there is less risk of misunderstandings. Both sides know what the contractual obligations are, which gives more clarity about what to do during the agreement.

Methods for Resolving Disputes and Governing Law

Clear steps are needed to deal with disagreements in an independent contractor agreement. At first, the people involved often try to fix problems through talking or mediation. The goal is to work together in a good way before moving to bigger steps like arbitration or going to court. Clauses about which laws apply are in the agreement.

These clauses make sure both sides know what rules to follow, what rights they have, and how to meet their duties. With a clear plan in place, everyone can avoid many misunderstandings. This also helps protect any proprietary information for the whole time both people work together.

Related Article: What is an Automatic Contract Renewal Clause? Detailed Guide

Conclusion

Getting through an independent contractor agreement does not have to be hard. When you have the right help, it can be much easier. Make sure you are clear about what you or the other side want. Talk about things like intellectual property, the end or termination of work, and what happens if either side wants to stop the deal.

Both the service provider and the hiring company should look at confidentiality carefully. Pick clear ways to handle disputes before problems come up, so both sides know what to do if things go wrong.

When you have a good contractor agreement in place, it shows what each person has to do. It helps protect people and makes work together much smoother. Always get legal advice to deal with special issues in your agreement.

Frequently Asked Questions

What is the difference between an independent contractor and an employee?

Independent contractors work under a contract for certain jobs. They get to decide how to do their work. Employees, on the other hand, do what their employer asks them to. They often get benefits like health insurance, job security, and the employer takes care of their taxes. It is important to know these differences when making contracts.

What should be included in an independent contractor agreement?

An independent contractor agreement needs to have a few important parts. These parts are the scope of work, payment terms, confidentiality clauses, rights over any intellectual property, and what happens if the agreement ends. You should write clear rules and what both sides expect from each other. This helps both people be safe and makes sure the agreement follows the law. This setup helps keep away misunderstandings and stops arguments from happening.

Can an independent contractor agreement be signed electronically?

Yes, you can sign an independent contractor agreement online if both sides agree to do it this way. Electronic signatures are legal in most places. This makes signing the contractor agreement faster and easier. However, it is a good idea to look into the local rules first to make sure you follow them.

About the Company

Volody AI CLM is an Agentic AI-powered Contract Lifecycle Management platform designed to eliminate manual contracting tasks, automate complex workflows, and deliver actionable insights. As a one-stop shop for all contract activities, it covers drafting, collaboration, negotiation, approvals, e-signature, compliance tracking, and renewals. Built with enterprise-grade security and no-code configuration, it meets the needs of the most complex global organizations. Volody AI CLM also includes AI-driven contract review and risk analysis, helping teams detect issues early and optimize terms. Trusted by Fortune 500 companies, high-growth startups, and government entities, it transforms contracts into strategic, data-driven business assets.