Krunal Shah

Dec 24, 2025

Key Highlights

Buy-side contracts focus on procurement, driven by procurement teams to manage costs and risks.

Sell-side contracts are for sales, managed by the sales team to boost revenue and speed.

These contract types have different goals but share a similar contract lifecycle.

Managing them separately creates silos and inefficiencies within your business.

A unified contract lifecycle management (CLM) system integrates both processes.

Using a single contract management software improves visibility, compliance, and overall efficiency.

Introduction

Every business engages in buying and selling, and these core activities are governed by contracts. The two main types are buy-side and sell-side contracts, each with unique goals and priorities. Understanding their differences is the first step towards effective contract management. By managing the entire contract lifecycle for both types correctly, you can align your teams, reduce risks, and improve your bottom line.

Understanding Buy Side Contracts and Sell Side Contracts

A buy-side contract is a legal agreement your company makes to purchase goods or services. Think of vendor agreements or supply agreements. The primary team involved is procurement, which focuses on getting the best value and minimising risk.

Conversely, a sell-side contract is used when your company sells its products or services to customers. These are revenue-generating agreements, such as sales agreements or Master Services Agreements (MSAs), driven by your sales team. Although they serve opposite functions, both require diligent management and compliance. Buy side and sell side contracts are most frequently used in industries such as finance, real estate, manufacturing, healthcare, and technology. These sectors routinely rely on complex agreements for purchasing supplies, outsourcing services, or selling products, making contract management especially critical. Up next, we will explore their definitions and differences in more detail.

Definition

A buy-side contract formalises the procurement process. It outlines the terms under which your organisation buys from external suppliers. The main focus is on optimising costs, ensuring quality, and managing vendor relationships. Procurement and finance teams are the key stakeholders who draft and manage these agreements.

A sell-side contract, on the other hand, is all about generating revenue. It defines the terms for selling your goods or services to a customer. Here, the priority is on speed, efficiency, and building strong customer relationships to secure sales and encourage repeat business. Your sales and account management teams typically handle these agreements.

Buy Side vs Sell Side Contracts

Aspect | Buy Side Contracts | Sell Side Contracts |

|---|---|---|

Definition | Govern the purchase of goods or services from vendors. | Govern the sale of goods or services to retailers or customers. |

Example | Retail chains like Tesco procure products from suppliers. | Apple sells iPhones to retailers or customers. |

Focus | Securing supplies at favorable terms. | Revenue generation and customer relations. |

Key Components | Delivery terms and pricing. | Payment schedules and warranties. |

Objective | Expenditure and risk mitigation. | Income and opportunity. |

Impact on Contract Terms | Shaped by priorities of cost and reliability. | Shaped by priorities of profit and customer satisfaction. |

Negotiation Priorities | Focus on favorable pricing and supply assurance. | Focus on customer needs and service conditions. |

Contract Lifecycle Approach | Management emphasizes procurement efficiency. | Management emphasizes sales performance and relationship building. |

Buy side contracts are the opposite: they govern the purchase of goods or services from vendors. For example, a retail chain like Tesco uses buy side contracts to procure products from suppliers for its stores, setting out delivery terms and pricing. Meanwhile, Apple enters into sell side contracts when selling iPhones to retailers or customers, making clear payment schedules and warranties. These examples illustrate how buy side contracts are focused on securing supplies at favourable terms, while sell side contracts concentrate on revenue generation and customer relations.

The core difference lies in their objectives. Buy-side agreements are about expenditure and risk mitigation, while sell-side agreements are about income and opportunity. This fundamental difference shapes the contract terms, negotiation priorities, and the entire contract lifecycle management approach for each.

The Goals and Priorities of Buy Side and Sell Side Contracts

The objectives behind buy-side and sell-side contracts are fundamentally different. For buy-side agreements, the priority is to secure necessary goods and services at the best possible price while ensuring contract compliance and managing supplier-related risks. Procurement teams lead this effort, focusing on cost-effectiveness.

In contrast, sell-side contracts are driven by the goal of maximising revenue and accelerating the sales cycle. The sales team focuses on closing deals quickly and efficiently to meet targets and grow the business. These differing priorities often lead to separate management processes, but aligning them can unlock significant value. We will now examine the specific objectives of each.

Procurement Objectives: Cost, Compliance, and Risk in Buy Side Contracts

When managing buy-side contracts, procurement teams have clear, strategic objectives. Their primary goal is to control spending and secure favourable terms that protect the company. This involves careful negotiation and a strong focus on risk management to avoid issues like supply chain disruptions or poor vendor performance.

During the document creation process, procurement ensures that the agreement terms align with the organisation's financial and operational policies. The aim is to create a robust legal agreement that minimises potential liabilities.

Key objectives for procurement include:

Cost Optimisation: Negotiating the best prices and recognising opportunities for discounts on high-volume or early payments.

Risk Mitigation: Ensuring suppliers comply with agreed-upon quality standards and delivery schedules.

Compliance Management: Holding vendors accountable and ensuring all agreements adhere to regulatory requirements.

Sales Priorities: Revenue and Speed in Sell Side Contracts

For sell-side contracts, the priorities shift dramatically towards revenue generation and speed. The sales team's main objective is to close deals as quickly as possible to meet targets and drive business growth. This means the document authoring process must be fast, scalable, and efficient to avoid delays in the sales cycle.

Building and maintaining strong customer relationships is also a top priority. Clear and fair payment terms, along with well-defined service levels, help build trust and encourage long-term partnerships. The contract serves as a foundation for a positive customer experience.

Sales priorities for sell-side contracts include:

Accelerated Revenue: Streamlining contract creation and approval to shorten the sales cycle and recognise revenue faster.

Customer Trust: Using clear, fair terms to build confidence and foster loyalty.

Upselling Opportunities: Leveraging existing contract data to identify chances for additional sales.

Related Article: Simplify Buy-Side & Sell-Side Contracts with Smart CLM Tools

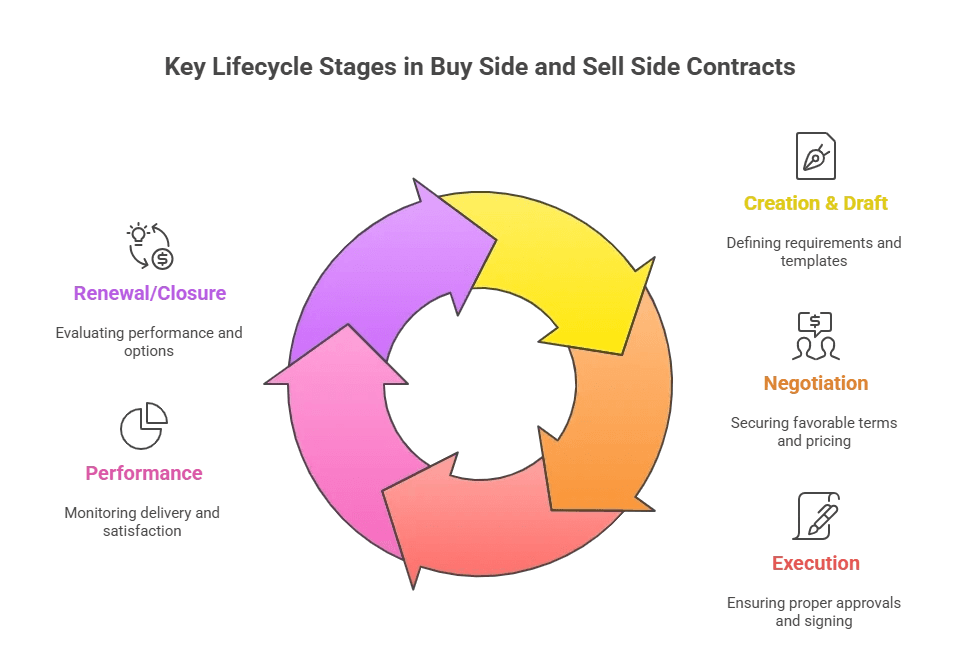

Key Lifecycle Stages in Managing Buy Side and Sell Side Contracts

Despite their different goals, both buy-side and sell-side contracts follow a similar contract lifecycle. This journey includes stages like drafting, negotiation, approval, execution, performance monitoring, and eventually, renewal or termination. Each phase requires careful oversight from contract managers to ensure the agreement delivers its intended value.

A modern contract management platform provides the tools needed to navigate each stage efficiently. By standardising these processes, you can gain better control over your contract data and improve outcomes for both buying and selling activities. Let's look at these phases and their unique challenges more closely.

Typical Phases from Draft to Renewal

The contract lifecycle management process provides a structured framework for all agreements. From initial contract creation to performance tracking, each phase is critical. While the stages are broadly the same for both buy-side and sell-side contracts, the focus within each phase differs based on the overall objective.

For instance, negotiation on the buy side centres on cost and risk, whereas on the sell side, it focuses on protecting revenue and service levels. Likewise, monitoring contract performance involves tracking supplier delivery for buy-side and customer satisfaction for sell-side. Effective contract lifecycle management ensures all contract terms are met and contract compliance is maintained.

Lifecycle Phase | Buy-Side Focus | Sell-Side Focus |

|---|---|---|

Creation & Draft | Defining clear requirements, ensuring compliance | Using pre-approved templates for speed |

Negotiation | Securing favourable pricing and risk-mitigating terms | Protecting revenue and defining service levels |

Execution | Ensuring proper approvals and secure signing | Accelerating the signing process to close deals |

Performance | Monitoring supplier delivery and quality | Tracking customer satisfaction and payment |

Renewal/Closure | Evaluating vendor performance for renewal decisions | Identifying upsell opportunities and ensuring renewal |

Unique Challenges and Legal Considerations for Each Contract Type

Each agreement type comes with its own set of challenges and legal risks. When dealing with third parties on the buy side, the primary concerns revolve around the supplier's ability to deliver as promised. This makes careful risk mitigation and compliance management essential.

On the sell side, risks are more often related to customer disputes and financial liabilities. The legal agreement must be carefully structured to limit your company's exposure while ensuring customer obligations are clearly defined.

Here are some unique challenges for each:

Buy-Side Challenges: Supplier reliability, unexpected cost increases, and poor quality of goods or services.

Sell-Side Challenges: Breaches of service level agreements (SLAs), disputes over payment terms, and customer dissatisfaction.

Related Article: What are Risks of Not Having a CLM Software?

Integrating Buy Side and Sell Side Contract Management with CLM Software

Managing buy-side and sell-side contracts in separate systems creates information silos, duplicates effort, and hinders visibility. The most effective solution is to integrate both processes using a unified Contract Lifecycle Management (CLM) software. This approach creates a single source of truth for all contract data across your organisation.

By bringing procurement and sales contracts onto one platform, you break down departmental barriers. A centralised CLM software allows your teams to work more cohesively, share insights, and streamline operations from a single dashboard. Let's explore the benefits this unified approach offers.

Benefits of a Unified System: Efficiency, Visibility, and Compliance

Adopting a unified system for both buy-side and sell-side contracts delivers immediate and significant benefits. It eliminates the need to pay for and manage two separate systems, reducing costs and administrative burden. This consolidation streamlines your entire contract management process, boosting overall efficiency.

With all contracts in one place, you gain complete visibility into your organisation's commitments and opportunities. This allows for better decision-making, as a sale can automatically trigger a procurement action. A unified system also simplifies compliance management by standardising controls and approval workflows across all contract types.

A single platform offers:

Greater Efficiency: Avoids duplicated processes and aligns teams with a single, streamlined workflow.

Complete Visibility: Provides a single repository for all contract data, offering insights into both spending and revenue.

Enhanced Contract Compliance: Standardises compliance checks and approvals for all agreements.

Common Challenges and How Indian Businesses Can Overcome Them

Indian businesses looking to adopt a unified contract management platform may face certain challenges. Departmental silos are common, with procurement and sales teams accustomed to their own business processes and tools. Gaining alignment from all business leaders is the first and most crucial step to overcoming this.

Another challenge is integrating the contract management platform with existing systems like ERP and CRM. The right provider will offer seamless integrations to ensure a smooth transition. Consulting with legal advisors on best practices can also help ensure the new system meets all regulatory and operational requirements.

Common hurdles include:

Resistance to Change: Departments may be reluctant to abandon familiar but inefficient processes.

System Integration: Ensuring the new CLM platform works with other essential business software.

Lack of a Unified Vision: Failure to get buy-in from leadership across all departments.

Conclusion

In summary, understanding the distinctions between buy-side and sell-side contracts is essential for any business looking to optimise its procurement and sales strategies. While buy-side contracts focus on cost control and risk management, sell-side contracts prioritise revenue generation and speed.

By integrating these processes through a unified Contract Lifecycle Management (CLM) software, businesses can break down silos, improve compliance, and enhance visibility across the contract lifecycle. This approach not only streamlines operations but also positions companies to navigate the complexities of contract management more effectively. To explore how you can implement these strategies in your organisation, get a free consultation with our experts today.

Frequently Asked Questions

Are there legal risks specific to either buy side or sell side contracts?

Yes. Buy-side contracts carry risks like supplier non-performance or quality failures. Sell-side contracts often involve risks related to liability for service delivery, breaches of service level agreements, and disputes over payment terms. Both require tailored risk management strategies within the legal agreement.

How do buy side and sell side contracts impact M&A transactions?

During mergers and acquisitions (M&A), both agreement types are vital for the due diligence process. Buy-side contracts reveal a company's liabilities and operational costs, while sell-side contracts show its revenue streams and customer obligations, helping to assess the target company's true value and risk profile.

About the Company

Volody AI CLM is an Agentic AI-powered Contract Lifecycle Management platform designed to eliminate manual contracting tasks, automate complex workflows, and deliver actionable insights. As a one-stop shop for all contract activities, it covers drafting, collaboration, negotiation, approvals, e-signature, compliance tracking, and renewals. Built with enterprise-grade security and no-code configuration, it meets the needs of the most complex global organizations. Volody AI CLM also includes AI-driven contract review and risk analysis, helping teams detect issues early and optimize terms. Trusted by Fortune 500 companies, high-growth startups, and government entities, it transforms contracts into strategic, data-driven business assets.