Krunal Shah

Feb 13, 2026

Key Highlights

An exemption clause in a contract aims to limit or remove a party's liability if a breach occurs.

Common types in contract law include the exclusion clause, limitation clause, and indemnity clauses.

These liability clauses are crucial for risk allocation in commercial agreements.

The impact of an exemption clause is significant, as it can reduce a party’s financial responsibility.

For a clause to be valid, it must have clear wording and comply with legal standards.

Consumer protection laws often place strict limits on these contract terms to ensure fairness.

Introduction

Have you ever signed a contract and wondered what protections you have if things go wrong? An exemption clause is a vital part of modern contract law that addresses this exact issue. These contract terms define the limits of responsibility for each party. This guide will serve as a beginner-friendly introduction to exemption clauses, explaining their role and importance within the legal context and helping you navigate your business agreements with more confidence.

Understanding Exemption Clauses in Contracts

An exemption clause is a specific term in a contract designed to limit or even completely remove one party’s liability under certain conditions. It sets clear boundaries on responsibility, which is why understanding these contractual terms is so important for managing risk.

The enforceability of an exemption clause depends on how it is written and whether it is fair. In the sections that follow, we will explore the definition, features, and types of these clauses to give you a clear picture of how they function.

Defining Exemption Clauses

So, what is an exemption clause in a contract? It is a provision within a legal document that one party uses to restrict or exclude its liability for a breach of contract or negligence. The main intent is to manage and allocate risk between the signing parties, making the potential for financial loss more predictable.

These contract terms are included to prepare for situations where something goes wrong. For example, a company might use an exemption clause to state it is not responsible for delays caused by events outside of its control, like severe weather or shipping disruptions.

In the normal course of business, unexpected events can lead to losses or damages. An exemption clause tries to create a fair framework by defining who bears the cost for these specific circumstances, preventing one party from being held unfairly responsible for issues they could not prevent.

Key Features of Exemption Clauses

Exemption clauses have specific characteristics that determine their function and validity in a contract. They are not all the same; some completely exclude liability, while others simply place a cap on the amount of damages that can be claimed. A limitation clause, for instance, sets a financial limit on a party’s responsibility.

These contractual terms affect a party's liability by clearly defining the boundaries of their obligations. The primary goal is to provide certainty and control over potential financial exposure in case of a breach. How effective the clause is depends heavily on how it is written and presented.

Key features that courts look for include:

Scope of the clause: It must clearly state what liabilities are being limited or excluded.

Clarity: The language must be precise and unambiguous.

Enforceability: The clause must be fair and reasonable to be upheld in a legal dispute.

Related Article: Mastering Contract Clauses: Risk & Performance

Common Types of Exemption Clauses

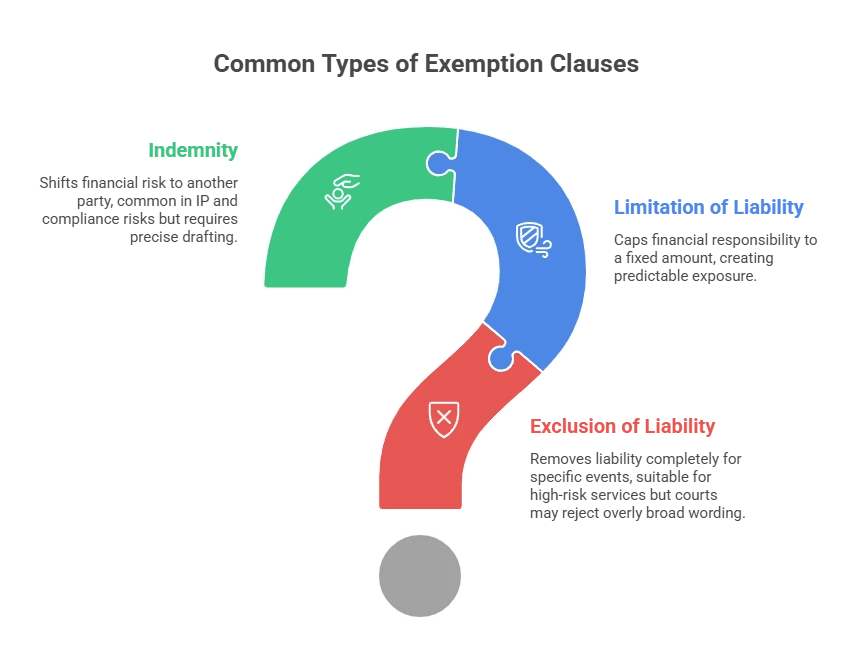

There are several types of exemption clauses used in contracts, each serving a distinct purpose. The most common ones you will encounter are exclusion clauses, limitation of liability clauses, and indemnity clauses. Understanding the differences between them is key to grasping how risk is managed in an agreement.

An exclusion clause aims to remove liability completely, while a limitation clause sets a cap on it. Indemnity clauses shift the financial responsibility for a loss from one party to another. The following sections will provide a closer look at these clauses with examples.

Exclusion of Liability Clauses

An exclusion clause is a powerful tool that aims to completely remove a party’s liability for specific outcomes, such as a breach of contract. For instance, a web hosting company might include a clause stating it is not responsible for downtime caused by third-party network failures. The goal is to absolve the party of any financial responsibility for events it cannot control.

These clauses are common in high-risk industries, but they are scrutinised carefully by courts. If the wording of the clause is too broad or ambiguous, it may be considered one of the unfair terms in a contract. A court may decide that it is unreasonable to allow one party to escape all responsibility, especially if it leaves the other party with no remedy.

The main difference between an exemption clause and an exclusion clause is that "exemption clause" is a broad term, while an "exclusion clause" is a specific type that completely removes a party's liability. All exclusion clauses are exemption clauses, but not all exemption clauses are exclusion clauses.

Limitation of Liability Clauses

A limitation clause, often called a limitation of liability clause, does not remove liability entirely. Instead, it sets a financial cap on how much a party can be held responsible for in the event of a breach. This is a more balanced approach to risk management, as it ensures the liable party still has some accountability.

For example, a software provider might include a limitation clause stating that its total liability for any claim will not exceed the fees paid by the customer in the last 12 months. This connects the potential damages to the contract value, preventing claims that are disproportionately high, such as for a huge loss of profits.

Yes, exemption clauses can and often do limit liability for damages. A well-drafted limitation clause provides predictability for both sides. It allows the service provider to manage its financial risk while giving the client a clear understanding of the maximum compensation they can expect if something goes wrong.

Indemnity Clauses

Indemnity clauses are another way to manage risk, but they work by shifting responsibility from one party to another. With these clauses, one party (the indemnitor) agrees to cover the losses or damages that the other party (the indemnitee) might suffer due to the indemnitor's actions or breach of duty.

These clauses affect a party's liability by transferring the financial consequences of a specific risk. For example, a marketing agency might agree to indemnify its client against any copyright infringement claims that arise from the campaign materials it creates. This ensures the party that caused the problem bears the financial burden of resolving it, not the innocent party.

Given their complexity and significant impact on contractual obligations, it is critical to seek legal advice when drafting or agreeing to indemnity clauses. The wording must be precise to avoid unexpected financial exposure or legal disputes down the line.

Related Article: What is Limitation of Liability Clause? An Effective Guide

Exemption Clauses vs Exclusion Clauses

While the terms "exemption clause" and "exclusion clause" are often used interchangeably, they have distinct meanings. Understanding the main differences is crucial for effective contract management. An exemption clause is the overarching category for any term that limits or excludes liability.

An exclusion clause is a specific type of exemption clause that seeks to remove liability completely. Getting this distinction right is important, as it affects how risk is allocated in a contract. The following sections will break down these differences with practical examples to help you see how they work.

Here is a simple table to summarise the main differences:

Aspect | Exemption Clause | Exclusion Clause |

|---|---|---|

Scope | Broad category including both limitation and exclusion clauses. | A specific type of clause that removes liability completely. |

Effect | Can either limit liability to a certain amount or exclude it. | Only excludes liability; it does not limit it. |

Legal Scrutiny | Generally viewed more favourably, especially limitation clauses. | Subject to very strict scrutiny and may be deemed unfair. |

Practical Examples in Contracts

Courts interpret exemption clauses by looking closely at the facts of the case and the specific wording of the contract terms. A famous example is Olley v Marlborough Court, where a hotel tried to rely on an exclusion notice inside a hotel room. The court ruled the clause was not valid because the guest could not see it until after the contract was formed at the reception desk.

This case shows that for an exemption clause to be enforceable, it must be properly incorporated into the contract before it is finalised. The Court of Appeal often reinforces this principle, emphasising that a party must have reasonable notice of the terms.

Here are a few practical scenarios where these clauses matter:

A software company limits its liability to the cost of the subscription.

A courier service excludes liability for delays caused by natural disasters.

A construction contract excludes liability for damage if the client provides faulty materials.

Where Are Exemption Clauses Commonly Found?

Exemption clauses are not hidden in obscure legal documents; you will find them in many types of contracts you encounter every day. They are a standard feature in most commercial contracts, from supplier agreements to partnership deals. You will also see them in online terms of service agreements and consumer contracts.

Their prevalence shows how important they are for businesses to manage risk across different sectors. The following sections will explore where these clauses are commonly used, including in service agreements, technology contracts, and consumer transactions.

Service Agreements

In service agreements, exemption clauses are used to define the boundaries of the provider's responsibility. These commercial contracts often contain clauses that limit liability in the event of a breach of contract, ensuring the provider is not exposed to unlimited financial risk. This directly affects a party’s liability by setting clear financial and operational limits.

The terms of the agreement will specify what happens if the service fails to meet expectations. For instance, a marketing agency might include a clause stating it cannot guarantee specific sales results from a campaign. This manages the client's expectations and protects the agency from being held liable for outcomes that are influenced by many factors beyond its control.

By allocating risk in this way, both parties can enter into the agreement with a clear understanding of their potential exposure. A well-drafted exemption clause brings certainty to the relationship and helps prevent disputes if a problem arises.

Technology and IT Contracts

Technology and IT contracts rely heavily on exemption clauses due to the complex and often unpredictable nature of software and digital services. A common type of exemption clause found in these agreements is the limitation of liability clause, which caps the provider's financial exposure for issues like data loss or service downtime.

Contract management software often helps companies standardise these clauses to ensure consistency and legal compliance across all their agreements. For example, a SaaS provider might use a template that includes a clause stating its total liability will not exceed the fees paid by the customer over the previous six months.

In technology contracts, exemption clauses are treated as essential risk management tools. They protect innovators from potentially crippling lawsuits over issues that may be outside their direct control, such as third-party network failures or cyberattacks, while still providing a remedy for the customer.

Related Article: What is Contract Risk & How to manage it?

Legal Validity and Enforceability of Exemption Clauses

The enforceability of an exemption clause is a key question in contract law. While these clauses are powerful tools, they are not automatically valid. For a clause to be upheld in court, it must meet several legal requirements, including being properly incorporated into the contract and being clearly worded.

Statutory limitations also play a major role, especially in protecting consumers. A clause that attempts to exclude liability for a fundamental breach of contract or that is considered unfair may be deemed unenforceable. The next sections will detail the requirements for a valid and enforceable clause.

The Role of Incorporation and Construction

For an exemption clause to be valid, it must be properly incorporated, meaning it has to be a legitimate part of the contract. This can happen in three ways: by being signed in the contract, by reasonable notice, or through a consistent previous course of dealings between the parties.

Once incorporated, the "construction" of the clause becomes vital. This refers to how courts interpret the wording of the clause. If the language is ambiguous or unclear, courts will apply the contra proferentem rule, which means the clause will be interpreted against the party who drafted it and is trying to rely on it.

This rule encourages clear and precise drafting. The wording of the clause must cover the specific situation that has occurred. A vaguely worded clause that tries to cover every possible scenario is less likely to be enforced than one that is specific and clear.

Statutory Limitations and Consumer Protection

Statutory limitations place significant restrictions on the use of exemption clauses, especially in the context of consumer protection. Consumer protection laws are designed to prevent businesses from imposing unfair terms on individuals who have less bargaining power.

These laws often render certain types of exemption clauses completely void. For instance, a clause that attempts to exclude a business's liability for causing death or personal injury through negligence is not legally enforceable. This is a fundamental protection that cannot be contracted out of.

Furthermore, consumer protection laws address the issue of unfair terms more broadly. If a clause creates a major imbalance in the rights and obligations of the parties and is detrimental to the consumer, it can be challenged and struck down. This ensures that contracts remain fair and equitable.

Beginner’s Guide: How to Approach Exemption Clauses in Contracts

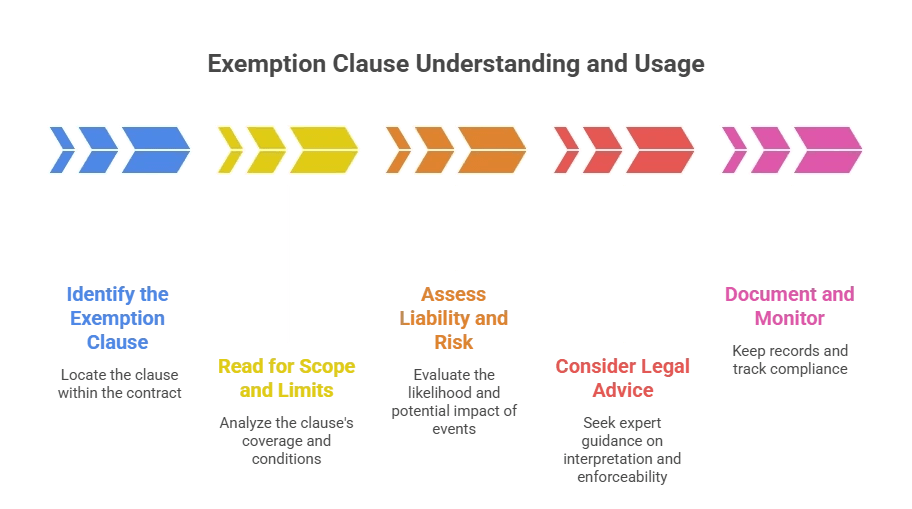

Navigating an exemption clause for the first time can feel daunting. However, by taking a structured approach, you can understand the terms of the contract and make informed decisions. This guide will provide you with a simple, step-by-step process for reviewing and assessing these clauses.

Before signing any agreement, it is crucial to understand its implications for your liability. The following steps will help you identify, read, and assess an exemption clause, ensuring you get the full picture before you commit. Remember, seeking legal advice is always a wise final step.

What You’ll Need to Get Started (Sample Contracts, Legal Resources)

To begin understanding an exemption clause, it helps to have the right resources at your disposal. This will allow you to compare examples and get a better sense of what to look for in any legal document. Effective contract management starts with being well-prepared.

Gathering a few sample contracts from your industry can be incredibly useful. You can see how different businesses handle risk and what is considered standard practice. Additionally, having access to online legal resources or guides can provide valuable context.

Here are a few things that will help you get started:

Sample contracts relevant to your business.

Access to online legal guides or articles on contract law.

Contract management software to organise and review documents.

A checklist of key terms to look for.

Step-by-Step Guide to Understanding and Using Exemption Clauses

Understanding an exemption clause doesn't have to be complicated. By following a clear, step-by-step process, you can break down the terms of the contract and assess their impact. This methodical approach to risk allocation will help you feel more confident when reviewing agreements.

The goal is to move from simply finding the clause to truly understanding what it means for you and your business. This involves careful reading, critical assessment, and checking for compliance with contract law.

Here is a simple five-step guide to follow:

Step 1: Identify the exemption clause in your contract.

Step 2: Read the clause carefully for scope and limits.

Step 3: Assess the impact on liability and risk.

Step 1: Identify the Exemption Clause in Your Contract

The first task is to locate the exemption clause within the contract. These contractual terms are often found in sections titled "Limitation of Liability," "Indemnity," or "Exclusions." Look for keywords like "not liable," "not responsible," "in no event shall," or "remedy shall be limited to."

When reviewing a legal document, take your time to read through all the terms of a contract. Do not just skim the main sections. An exemption clause can significantly alter your rights and obligations, so it is crucial to know where it is and what it says.

Modern contract management software can make this process easier by allowing you to search for specific keywords across a document. This helps ensure you do not miss any important clauses that could affect your position.

Step 2: Read the Clause Carefully for Scope and Limits

Once you have found the exemption clause, you need to read it very carefully. Pay close attention to the scope of the clause. What exactly is being excluded or limited? Is it liability for delays, data loss, or financial damages? The more specific the clause, the easier it is to understand.

Be on the lookout for language that could create a significant imbalance between the parties. If the contract terms seem overly one-sided, it is a major red flag. For example, if a clause tries to exclude liability for the company's own negligence in performing its core duties, it may be considered unfair.

Take your time to understand every word. Do not rush this step. If any part of the clause is confusing or ambiguous, make a note to ask for clarification or seek legal advice.

Step 3: Assess the Impact on Liability and Risk

After reading the clause, the next step is to assess its practical impact. How does this exemption clause affect your liability and the overall risk allocation in the contract? Think about the worst-case scenarios. If something goes wrong, what financial or operational risks will you be responsible for?

Consider the different types of loss the clause covers. Does it limit liability for direct damages only, or does it also exclude indirect losses like loss of profits? These liability clauses can have a huge financial impact, so it is important to understand the full extent of the risk you are accepting.

This assessment will help you decide if the risk allocation is fair and acceptable for your business. If the clause shifts too much risk onto you without any corresponding benefit, you may need to negotiate for more balanced terms.

Best Practices for Drafting and Negotiating Exemption Clauses

Whether you are drafting an agreement or reviewing one, there are several best practices to follow for exemption clauses. The key is to aim for clarity, fairness, and legal compliance. The wording of the clause is critical, as any ambiguity can render it useless.

Effective negotiation can also lead to more balanced contract terms that protect both parties. The following section will offer tips on how to draft and negotiate these clauses to ensure they are both effective and enforceable, reducing the risk of future disputes.

Using Clear and Precise Language

The single most important best practice for drafting an exemption clause is to use clear and precise language. Vague or overly broad terms are the biggest enemies of an enforceable clause. If the wording is ambiguous, a court is likely to interpret it in the way that is least favourable to the party trying to rely on it.

This legal principle, known as the contra proferentem rule, acts as an incentive for clear drafting. Instead of using sweeping statements like "the company is not liable for any losses whatsoever," be specific. Clearly define which risks are being excluded or limited, such as "delays caused by third-party shipping providers."

Your goal is to leave no room for doubt about the clause's meaning and scope. Plain, straightforward language is always better than complex legal jargon. A clause that everyone can understand is far more likely to be considered fair and enforceable.

Ensuring Fairness and Transparency

Incorporating clear wording in exemption clauses ensures fairness and transparency in contracts. This practice helps prevent significant imbalance in the relationship between parties. Consumers and businesses alike should understand the terms of a contract to mitigate potential liability. By clearly stating limitations and exclusion of liability, parties can avoid misunderstandings that lead to disputes. Recognising unfair contract terms is vital to protect one's interests. Engaging in proper contract management and obtaining legal advice enhances the enforceability of these clauses, allowing for better risk allocation and adherence to contractual obligations.

Conclusion

Understanding exemption clauses is essential for anyone involved in contracts. They help define the boundaries of liability, offering protection against unforeseen circumstances. However, an imbalance in the wording can lead to unfair terms, influencing enforceability under the unfair contract terms act. Always consider the scope of the clause and its implications on parties' obligations. Seeking legal advice preemptively can clarify potential issues and ensure better contract management. Ultimately, a balanced contract enhances trust and supports fair dealings between parties while adhering to legal standards.

Frequently Asked Questions

How do exemption clauses affect liability in contracts?

Exemption clauses can limit or exclude liability in contracts, which affects the obligations and rights of the parties involved. They can offer protection for one party while potentially imposing unfair risks on the other, highlighting the need for careful consideration during contract negotiation.

Can an exemption clause protect against all types of damages?

An exemption clause typically does not protect against all types of damages. Courts may enforce them only if they are clear, reasonable, and proportionate. Additionally, certain damages, like personal injury or fraud, often cannot be excluded under public policy considerations.

What should I check before agreeing to an exemption clause?

Before agreeing to an exemption clause, check its clarity, fairness, and reasonableness. Ensure you understand the legal implications and potential consequences if things go wrong. Additionally, assess whether it limits liability excessively or unduly disadvantages one party over another.

About the Company

Volody AI CLM is an Agentic AI-powered Contract Lifecycle Management platform designed to eliminate manual contracting tasks, automate complex workflows, and deliver actionable insights. As a one-stop shop for all contract activities, it covers drafting, collaboration, negotiation, approvals, e-signature, compliance tracking, and renewals. Built with enterprise-grade security and no-code configuration, it meets the needs of the most complex global organizations. Volody AI CLM also includes AI-driven contract review and risk analysis, helping teams detect issues early and optimize terms. Trusted by Fortune 500 companies, high-growth startups, and government entities, it transforms contracts into strategic, data-driven business assets.