Krunal Shah

Dec 12, 2025

Managing risk is essential for protecting your business. One of the most important tools for this is the limitation of liability clause. This provision is a standard feature in most agreements and plays a critical role in defining the financial boundaries of a business relationship.

Understanding these contract terms is key to effective risk management and can prevent potentially huge financial losses. This guide will explore what this clause is, why it matters, and how to use it effectively.

What is a Limitation of Liability Clause in Contracts?

A limitation of liability clause is a specific provision within a contract designed to cap the amount of damages a party can be required to pay if something goes wrong. Think of it as a financial safety net that defines the maximum financial responsibility in the case of a breach or failure to meet contractual obligations.

These liability clauses are a fundamental part of contract law, helping to make risks predictable. Without them, a business could face unlimited and potentially catastrophic losses from a single dispute. Now, let's look closer at its definition, purpose, and where you'll typically find it.

Definition and Overview

At its core, a limitation of liability clause is a provision in a legal agreement that restricts the amount and types of compensation one party can claim from the other. In the event of a breach of contract, negligence, or other specified issue, this clause sets a pre-agreed ceiling on financial exposure.

Essentially, the clause answers the critical question: "If the worst happens, what is the maximum financial responsibility we have?" It establishes a clear threshold for the total liability, ensuring that the potential damages are proportional to the value of the agreement. This prevents a situation where a minor issue could lead to disproportionate financial consequences.

By setting these boundaries, both parties can enter into an agreement with a clearer understanding of their potential risks. These contract terms are not about avoiding responsibility but about making the financial stakes predictable and manageable.

Typical Use Cases in Commercial Agreements

You will find limitation of liability clauses in a vast range of commercial contracts, as they are a fundamental part of modern business dealings. Their structure and scope often depend on the industry and the specific risks involved in the agreement. Effective contract management involves tailoring these clauses to the situation.

These provisions are particularly common in agreements for professional services, where providers want to limit their exposure for errors or omissions. They are also standard in technology and software contracts, where a small bug could potentially cause significant downstream losses for a client.

Here are a few common examples of where you would find them:

Software Licensing Agreements: Providers often limit their liability to the fees paid and exclude responsibility for lost data or profits.

Supply and Manufacturing Agreements: Suppliers may cap their liability for defective goods at the purchase price of the product.

Consulting and Service Contracts: Consultants frequently limit their liability to the total fees paid for the specific services that gave rise to the claim.

Related Article: Contract Clause Library: Your Comprehensive Guide

Importance of Limitation of Liability Clauses

Including a limitation of liability clause is not just a formality; it's a crucial strategic decision. Its primary importance lies in effective risk management. By capping potential financial exposure, businesses can protect themselves from unforeseen and potentially devastating losses that could far exceed the contract value.

This clause encourages businesses to form relationships they might otherwise deem too risky, fostering innovation and commerce. It creates a fair and predictable framework for allocating risk between parties. Let's examine how this translates into practical benefits for your business.

Risk Management for Businesses

The foremost function of a limitation of liability clause is to manage and reduce financial risk. In any commercial contract, there is a degree of uncertainty. This provision helps quantify that uncertainty by setting a clear ceiling on potential liability.

For any business, this predictability is vital. It allows you to better forecast your financial exposure and protect your organisation from catastrophic losses that could arise from a breach of contract or an unexpected event. Without this protection, a single dispute could jeopardise the financial stability of your entire company.

By capping potential damages, you transform an unknown financial risk into a known, manageable figure. This allows for more accurate financial planning and ensures that the risks associated with any single contract do not pose an existential threat to your business.

Facilitating Fair Negotiations

A well-drafted limitation of liability clause is a cornerstone of fair contract negotiations. It ensures that the risk assumed by each of the contracting parties is proportional to the reward they stand to gain from the agreement. This balance is essential for healthy and sustainable commercial relationships.

When the potential liability is aligned with the value of the contract, both parties can enter the agreement with confidence. It provides a sense of security, encouraging businesses to collaborate on projects that might otherwise appear too risky. This is particularly important for smaller companies working with larger corporations, as it protects them from disproportionate claims.

Ultimately, these clauses help create a more equitable distribution of risk. By clearly defining the financial stakes from the outset, they allow both parties to negotiate from a place of clarity and fairness, establishing a solid foundation for their partnership.

Promoting Certainty and Predictability

One of the most practical benefits of a limitation of liability clause is the certainty and predictability it brings to contractual terms. By setting clear financial boundaries, the clause simplifies the process of dispute resolution should a problem arise.

When both parties know the maximum potential recovery amount, it often encourages faster settlements. The incentive for long and expensive litigation is reduced because the financial stakes are already defined. This predictability helps save time, legal fees, and the commercial relationship itself.

This certainty also extends to business planning. Knowing your maximum financial exposure on a contract allows for more stable financial forecasting and can even help reduce the cost of insurance premiums. It brings a level of predictability to your contractual relationships that is essential for long-term business stability.

Common Types of Limitation of Liability Clauses

Limitation clauses are not one-size-fits-all; they come in various forms to suit different contracts and business needs. The most common types focus on either capping the total amount of damages or excluding certain types of damages altogether.

Understanding these different approaches is key to drafting a clause that effectively protects your interests. The structure can range from a straightforward financial cap on aggregate liability to more nuanced exclusions. Below, we'll explore some of the most common types you are likely to encounter.

Financial Caps on Liability

The most direct form of limitation is a financial cap on liability. This sets an absolute maximum amount of money that a party can be held responsible for in the event of a breach. This liability cap provides a clear, quantifiable limit on potential financial loss.

These caps can be structured in several ways. A common approach, especially in service agreements, is to tie the cap to the fees paid under the contract over a specific period, such as the preceding 12 months. This directly links the maximum amount of damages to the economic value of the relationship.

Another way is to set a fixed monetary amount (e.g., “£1,000,000”). This is more common in high-value transactions where fees might not be recurring. Sometimes, a clause will use the greater of two options to establish a minimum floor of liability, ensuring a baseline level of protection.

Exclusion of Consequential Damages

Arguably more important than the financial cap is the exclusion of consequential damages. These are also known as indirect or special damages, and they refer to losses that are not a direct result of the breach but are a consequence of it.

For example, if a faulty piece of machinery (the direct damage) causes a factory to shut down, the lost profits from the shutdown are considered consequential damages. These damages can be vast and unpredictable, creating significant financial exposure. Because of this, almost every limitation of liability clause includes a waiver where both parties agree not to sue each other for these downstream losses.

By excluding these types of damages, the contract terms ensure that liability is confined to more foreseeable and direct losses. This is a critical component of managing risk and preventing claims from spiralling into unmanageable figures.

Time Limitations and Survival Clauses

Another way to limit liability is by setting a time limit within which claims must be made. This is essentially a contractual statute of limitations, often requiring that any claim be brought within 12 to 24 months of the breach. This promotes finality and prevents parties from being exposed to potential claims indefinitely.

In addition, a survival clause ensures that certain contractual obligations, including the limitation of liability itself, continue to be in effect even after the contract is terminated. This is important because a breach or its discovery might occur near or after the end of the contract term.

Effective contract management involves using these clauses to provide certainty for dispute resolution. The survival clause reinforces post-contract accountability for key obligations like confidentiality and indemnification, while the time limit encourages prompt action if issues arise.

Related Article: AI-Powered Clause Library: Faster & Efficient Drafting

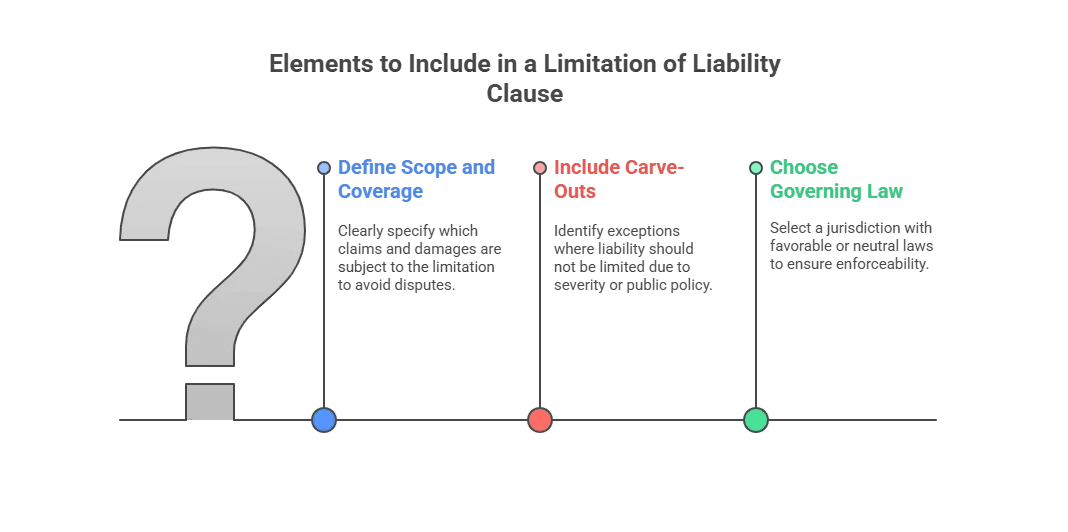

Essential Elements to Include in a Limitation of Liability Clause

A well-drafted limitation of liability provision is carefully constructed with several distinct parts. Understanding these key components is crucial for both drafting and negotiating them effectively, ensuring your contractual terms are robust and enforceable under contract law.

From defining what is covered to outlining what is excluded, each element plays a role in creating a balanced and legally sound clause. Let’s break down the essential elements you must include to build a strong financial safeguard for your business.

Scope and Coverage

The first essential element is to clearly define the scope and coverage of the limitation of liability. This part of the clause specifies which types of claims and damages are subject to the limitation. It needs to be unambiguous to avoid disputes over interpretation later on.

Typically, the scope will cover claims arising from breach of contract, negligence, or failure to perform. It should state whether it applies to direct damages only or if it also addresses other categories of loss. The goal is to be as explicit as possible about what falls under the liability cap.

Here’s a simple breakdown of what is often included versus excluded in the scope of a limitation of liability clause:

Covered by Limitation | Often Excluded from Limitation (Carve-Outs) |

Direct damages from breach of contract | Gross negligence or willful misconduct |

Losses due to ordinary negligence | Breach of confidentiality obligations |

Certain incidental costs | Intellectual property infringement claims |

Service performance failures | Bodily injury or property damage |

Carve-Outs and Exceptions

The liability cap is not absolute. Carve-outs, or exceptions, are specific types of claims that are excluded from the limitation of liability. These are areas where the responsible party should not be able to limit their liability, often due to public policy or the severity of the potential harm.

Negotiating these carve-outs is often one of the most contentious parts of finalising a contract. They represent the high-risk areas where one party is unwilling to accept a capped level of financial responsibility from the other.

Common carve-outs include:

Gross Negligence or Willful Misconduct: You generally cannot limit your liability for reckless or intentionally harmful actions.

Breach of Confidentiality: If a party leaks sensitive information, the resulting damages are often not capped.

Intellectual Property (IP) Infringement: A party that steals or misuses the other’s IP cannot hide behind the liability cap.

Governing Law and Jurisdiction Considerations

The choice of governing law and jurisdiction has a significant impact on the enforceability of your limitation of liability clause. Different legal systems have varying rules and interpretations, so this provision is crucial for creating certainty in dispute resolution.

For instance, the enforceability of a clause under Indian law may differ from that under UK or US law. The Unfair Contract Terms Act in the UK, for example, places specific restrictions on such clauses, particularly in business-to-consumer contracts. Specifying the jurisdiction helps avoid conflicts and ensures the clause is interpreted as intended.

Good contract management practice dictates that you choose a jurisdiction whose laws are well-understood and favourable to your position, or at least neutral. This provision reduces uncertainty and prevents "forum shopping," where a party might try to file a lawsuit in a jurisdiction with more favourable laws.

Negotiating a Fair Limitation of Liability Clause

The limitation of liability clause is one of the most heavily negotiated terms in any commercial agreement. It is rarely a 'take it or leave it' proposition. The goal of the negotiation is to find a fair balance that protects both contracting parties without stifling the business relationship. Effective risk management depends on reaching a compromise that reflects the specific context of the deal, including its value and potential risks.

Achieving a fair outcome requires strategic thinking and a clear understanding of your priorities. Both sides must be prepared to justify their positions and find middle ground. Whether you are a service provider or a customer, your approach to this negotiation will differ. Using a robust contract lifecycle management software can help track these negotiations and ensure your final agreement aligns with your risk policies.

Strategies for Service Providers

If you are a service provider, your main goal is to limit your financial risk to a predictable and manageable level. Your pricing is often based on this assumed level of risk, so it is a critical part of your business model.

A key strategy is to explain that your pricing reflects the proposed risk allocation. If the customer wants you to take on more liability, the price of your service will need to increase accordingly to cover the additional financial risk.

Here are some effective strategies for service providers:

Tie the Liability Cap to Fees: Propose a cap linked to the fees paid over a defined period (e.g., 12 months). This directly connects your liability to the contract value.

Resist Broad Carve-Outs: Be very careful about which claims you agree to exclude from the cap. For high-risk areas like data breaches, try to negotiate a separate, higher cap rather than accepting unlimited liability.

Start with a Strong Standard: Your template agreement should include a clear and reasonable limitation of liability clause as your starting position.

Strategies for Customers and Buyers

As a customer or buyer, your priority is to ensure you have meaningful recourse if the provider fails to deliver on their promises. You want to avoid a situation where the liability cap is so low that it doesn't adequately cover your potential direct damages.

Your negotiation should focus on ensuring the contract terms provide fair protection for your business opportunities and that the provider accepts appropriate financial responsibility for critical failures. Scrutinising the proposed limitations is your most important job.

Here are some strategies for customers:

Push for a Higher Cap: Argue that a standard cap (like 12 months of fees) may not be sufficient to cover your direct losses in a worst-case scenario. Propose a higher fixed amount or a multiplier of fees.

Demand Specific Carve-Outs: Identify the key risks to your business and insist that they are carved out of the limitation. This could include IP infringement, confidentiality breaches, or regulatory fines.

Ensure Mutuality: If the provider is limiting their liability, you should ensure the clause applies equally to both parties, limiting your liability as well.

Related Article: 10 Tips for Contract Negotiation : Strategies Toward Success

Risks of Not Including a Limitation of Liability Clause

Omitting a limitation of liability clause from your contract is like sailing in a storm without a life raft. Without this protection, your business is exposed to unlimited liability for damages. This means your potential financial exposure is not capped by the contract value and could be determined by general contract law.

This level of uncertainty can be devastating, putting your company at significant financial risk and straining business relationships. Let’s explore the specific dangers of facing unlimited claims and the impact it can have on your commercial dealings.

Exposure to Unlimited Claims

The most significant risk of not having a limitation of liability clause is exposure to unlimited claims. In the event of a breach or dispute, a court could hold your organisation fully accountable for all direct, indirect, consequential, and even punitive damages, depending on the circumstances.

This means there is no maximum amount to cap the potential losses. For any business, but especially for small to medium-sized enterprises, this level of financial risk is untenable. A single large claim could lead to devastating financial consequences, far exceeding any revenue generated from the contract.

Without this protective clause, you are left vulnerable to a vast and unpredictable range of claims. This uncertainty makes it impossible to accurately assess the financial risk of any given contract, leaving your business exposed and unprotected.

Impact on Contract Value and Commercial Relations

The absence of a limitation of liability clause can also negatively impact the perceived contract value and your commercial relationships. When one or both parties face unpredictable financial risk, it creates an unstable foundation for the partnership.

This uncertainty can make businesses hesitant to enter into agreements, stifling innovation and collaboration. A provider might need to charge significantly higher prices to compensate for the unlimited risk, or a buyer might see the deal as too dangerous to pursue.

The impact includes:

Strained Negotiations: The lack of a clear risk allocation framework can lead to difficult and protracted negotiations.

Damaged Trust: If a dispute arises, the potential for unlimited damages can quickly escalate the conflict and destroy the business relationship.

Increased Costs: Businesses may need to secure more expensive insurance policies to cover the potential for unlimited liability, increasing operational costs.

Types of Damages Typically Excluded

A key function of a limitation of liability clause is to specify which types of damages are not recoverable. This is just as important as setting a financial cap. The most commonly excluded categories are consequential damages and other indirect losses, also known as special damages.

By excluding these, the clause aims to limit liability to more predictable, direct damages that flow immediately from a breach. Let's explore the distinction between direct and consequential damages and why excluding the latter is standard practice.

Direct vs Consequential Damages

Understanding the difference between direct and consequential damages is fundamental to contract law. Direct damages are the losses that result naturally and immediately from a breach of contract. For example, if you buy a faulty server for £10,000, the £10,000 cost of the server itself is the direct damage.

Consequential damages, on the other hand, are the indirect losses that occur as a downstream result of the breach. In the server example, if the faulty server caused your e-commerce website to be down for a day, resulting in £200,000 of lost sales, that lost profit is a consequential damage.

Limitation of liability clauses typically allow for the recovery of direct damages (up to the liability cap) but explicitly exclude the recovery of consequential damages. This is because the amount of damages in the latter category can be speculative and disproportionately large compared to the contract's value.

Exclusions for Indirect and Special Damages

In addition to consequential damages, commercial contracts often explicitly exclude other types of indirect and special damages. These terms are sometimes used interchangeably with consequential damages, but they can cover a broader range of unforeseeable losses that do not stem directly from the breach. The goal is to prevent claims for speculative or catastrophic losses.

These exclusions are standard practice because they provide certainty and prevent parties from being held liable for a chain reaction of events beyond their reasonable control or foresight. Without them, the potential for liability could be virtually limitless.

Commonly excluded types of damages include:

Lost Profits or Revenue: As these are often speculative and hard to prove.

Loss of Business Opportunities: The loss of potential future deals is considered too remote.

Damage to Reputation or Goodwill: These are intangible losses that are difficult to quantify financially.

Conclusion

In conclusion, understanding the Limitation of Liability Clause in contracts is essential for both parties involved. It helps define the extent of risk and liability each party is willing to accept, promoting fairness and clarity in commercial agreements. By incorporating such clauses, businesses can effectively manage potential risks, negotiate terms that are beneficial, and safeguard against unexpected claims that could jeopardise their operations.

As you navigate your contractual obligations, ensure these clauses are tailored to fit your specific needs. If you have questions or require assistance in drafting a robust Limitation of Liability Clause, don't hesitate to reach out for expert guidance.

Frequently Asked Questions

What damages are usually excluded by these clauses?

Limitation of liability clauses in commercial contracts typically exclude indirect damages to prevent unmanageable financial loss. This includes consequential damages like lost profits, incidental costs, special damages that are unique to a situation, and punitive damages intended to punish rather than compensate. Direct damages are generally not excluded unless explicitly stated.

Can both parties have limitation of liability clauses in a contract?

Yes, it is very common and often considered fair for both contracting parties to have mutual liability clauses in a contract. This ensures that the risk management protections apply equally to both sides, capping the potential exposure for each party and creating a more balanced set of contract terms.

What is a limitation of liability clause?

A limitation of liability clause is a provision in a contract that caps the amount and types of damages one party can claim from the other. It's a critical risk management tool in commercial contracts, designed to make potential financial exposure predictable and manageable in case of a breach.

Why are limitation of liability clauses important in contracts?

These clauses are important because they provide financial protection and predictability. They are a core part of risk management in commercial contracts, ensuring that a party's financial exposure is proportional to the contract value and protecting businesses from potentially catastrophic and unlimited losses arising from a single dispute.

About the Company

Volody AI CLM is an Agentic AI-powered Contract Lifecycle Management platform designed to eliminate manual contracting tasks, automate complex workflows, and deliver actionable insights. As a one-stop shop for all contract activities, it covers drafting, collaboration, negotiation, approvals, e-signature, compliance tracking, and renewals. Built with enterprise-grade security and no-code configuration, it meets the needs of the most complex global organizations. Volody AI CLM also includes AI-driven contract review and risk analysis, helping teams detect issues early and optimize terms. Trusted by Fortune 500 companies, high-growth startups, and government entities, it transforms contracts into strategic, data-driven business assets.