Krunal Shah

Feb 23, 2026

Key Highlights

Penalty clauses are contractual provisions that set a specific sum to be paid following a breach of contract. Recent legal cases, such as Cavendish Square Holding BV v Talal El Makdessi [2015] UKSC 67 and ParkingEye Ltd v Beavis [2015] UKSC 67, have significantly affected the enforceability of penalty clauses in the UK, establishing that courts should consider whether a contractual provision protects a legitimate business interest and whether the sum stipulated is proportionate to that interest. It is advisable to seek professional legal advice regarding the implications of these cases on your contracts.

These clauses differ from liquidated damages, which represent a genuine pre-estimate of loss. In English law, in the case of a breaching party, the enforceability of penalty clauses depends on whether they protect a legitimate interest or are excessively punitive.

Indian contract law, under the Contract Act, 1872, focuses on "reasonable compensation," making excessively high penalties unenforceable. Recent legal cases, such as Fateh Chand v. Balkishan Dass (1963) and Maula Bux v. Union of India (1969), have reinforced that courts will not enforce penalty clauses that prescribe amounts disproportionate to the actual loss suffered, highlighting the importance of effective dispute resolution mechanisms.

More recently, Supreme Court judgments have continued to uphold the requirement that penalty clauses in contract law must be reasonable, keeping the emphasis on protecting parties from unfair contractual obligations and safeguarding a legitimate interest of the innocent party. The primary purpose of these clauses is to deter a party from breaking their contractual obligations. Courts will not enforce a penalty that is extravagant compared to the greatest possible loss for the innocent party.

Introduction

When you enter into a contract, you expect all parties to fulfil their promises. But what happens when they do not? A penalty clause is a tool used in contract law to discourage a breach of contract and protect against potential harm. These damages clauses specify a consequence, usually a financial payment, if a party fails to meet their obligations. Understanding how these clauses work is crucial for anyone dealing with commercial contracts, as their validity and enforcement can be complex and vary between jurisdictions.

Defining the Penalty Clause in Contract Law

So, what is a penalty clause in a contract? It is an express contractual provision that requires a party who has breached the contract to pay compensation to the other party for the breach of this contract. The key here is that this payment is often designed to be a punishment rather than a simple reimbursement for the actual loss suffered.

This clause imposes a secondary obligation, which is only triggered if a primary obligation of the contract is broken. For example, if the primary duty is to deliver goods on time, the secondary obligation to pay a penalty would only arise if the delivery is late. This aspect is central to how courts analyse these clauses.

Key Features of a Penalty Clause

A defining feature of penalty clauses is that they stipulate a sum of money that is often inflated and not proportional to the loss caused by the breach. The intention is to put pressure on the breaching party to perform their part of the obligation and contractual duties, making non-performance an expensive option.

The legal test for these clauses has evolved. Historically, courts only checked if the sum was a "genuine pre-estimate" of the loss. However, modern English law, following the Cavendish Square case, introduces a new test that examines the true nature of the clause. It first determines if the clause represents a primary or secondary obligation. A primary obligation is a core contractual duty, while a secondary obligation is one triggered by a breach of contract.

If the clause is a secondary obligation, the court then assesses if it is penal in nature. A clause is considered penal in the case of wilful default if it imposes a consequence on the breaching party that is completely out of proportion to any legitimate interest the innocent party has in the enforcement of the primary obligation. This makes the enforceability of penalty clauses a nuanced issue.

Objectives and Rationale Behind Penalty Clauses

You might wonder why businesses include penalty clauses in their agreements. The core objective is to ensure the performance of a contract. By setting a high cost for failure, these clauses act as a powerful deterrent against a potential breach, provided that the terms are agreed upon and negotiated in good faith.

This protects the innocent party by giving them a clear path to compensation tailored to their specific needs without having to prove their exact losses in court, which can be time-consuming and costly. It safeguards the legitimate interest a party has in seeing the contract fulfilled as promised. These damages clauses create certainty and predictability in commercial relationships.

The main goals behind including such a provision are to:

Encourage timely and complete performance of contractual obligations.

Discourage wilful defaults or breaches.

Provide a pre-agreed remedy for the injured party.

Avoid complicated and lengthy disputes over calculating actual damages.

Related Article: WCC Top 10 Negotiated Terms of 2024

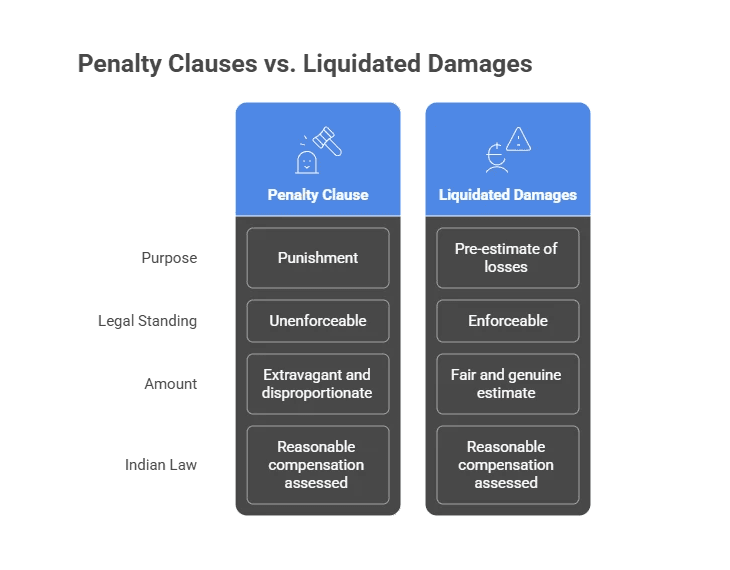

Distinction Between Penalty Clauses and Liquidated Damages

It is essential to understand the difference between penalty clauses and liquidated damages. While both are triggered by a breach of contract, their legal standing and purpose are distinct. A liquidated damages clause sets out a sum that is a genuine and reasonable pre-estimate of the losses the innocent party is likely to suffer in the event of a breach.

In contrast, a penalty clause specifies a sum intended to punish the breaching party, which is often extravagant and disproportionate to the actual damage. The enforceability of penalty clauses is often challenged in commercial contracts because the law generally does not support punishing a party beyond compensating for the actual loss, considering the specific circumstances of each case. This distinction is crucial for drafting enforceable damages clauses. Now, let's explore their legal definitions and practical differences.

Legal Definitions and Differences

In contract law, the line between a penalty and liquidated damages is fine but firm. A liquidated damages clause is a pre-agreed amount that represents a fair and genuine estimate of the potential loss from a breach, which can come in different shades. Courts generally uphold these clauses because they provide certainty and a reasonable remedy for the injured party.

On the other hand, penalty clauses are viewed as a threat to force performance. Their purpose is punishment, not compensation, which is why English law considers them contrary to public policy and generally unenforceable. The expression 'penalty' itself implies an idea of punishment through penal damages, a concept that lacks a precise definition.

Indian contract law takes a slightly different approach, focusing on the importance of reasonable compensation and 'reasonable compensation' regardless of whether the clause is a penalty or liquidated damages. The court will not award more than the stipulated amount but will assess what is reasonable in the circumstances of the case.

Feature | Penalty Clause | Liquidated Damages Clause |

|---|---|---|

Purpose | To deter a breach by imposing a punishment. | To compensate for a breach with a genuine pre-estimate of loss. |

Amount | Extravagant and disproportionate to the actual loss. | A reasonable and fair estimate of the anticipated loss. |

Enforceability | Generally unenforceable in English law; subject to 'reasonable compensation' in India. | Generally enforceable if it is a genuine pre-estimate of loss. |

Practical Examples Illustrating the Distinction

Let's consider some practical scenarios to clarify the difference. Imagine a contract where a software developer agrees to deliver a new application by a specific date. The contract includes a clause for late delivery.

If the clause states that the developer must pay £100 per day of delay for the breach of the contract, and this amount reasonably reflects the client's daily loss of revenue from the delayed launch, it is likely a liquidated damages clause. The sum is a fair pre-estimate of the harm caused.

However, if the clause demands a payment of £1,000,000 for a single day of delay, this would almost certainly be seen as a penalty. The sum is excessive and disproportionate to the actual loss, serving only to punish the developer. This is a classic example of a secondary obligation designed to be a deterrent.

Here are a few more examples:

Liquidated Damages: A construction contract specifies a daily fee for project delays that covers the cost of renting alternative premises.

Penalty: A service agreement states that if a minor reporting deadline is missed, the provider must forfeit the entire contract fee.

Related Article: Express Contracts: Enforceability & Drafting Laws

Types of Penalty Clauses Found in Indian Contracts

Within the framework of the Indian Contract Act, 1872, the concept of a penalty clause is approached with a focus on reasonability, aligning with the doctrine of reasonable compensation. The law does not strictly distinguish between a penalty and liquidated damages in the way English law does. Instead, Section 74 of the Contract Act governs both.

Under this section, if a contract specifies a sum to be paid in case of a breach, the aggrieved party is entitled to receive reasonable compensation not exceeding the amount named, and not in excess of the breach. This means that even if a clause is clearly a penalty, Indian courts will not enforce the full amount but will instead determine what is fair. We will now look at the different forms these penalties can take.

Monetary vs. Non-Monetary Penalties

When discussing penalty clauses, most people think of monetary penalties. These are the most common type, where the defaulting party is required to pay a specific sum of money to the other party, considering the paying capabilities of the parties. This amount is outlined in the contract and is triggered by a failure to perform an obligation. For example, a contract might state that a supplier must pay a fee for each day a delivery is late.

However, it is also possible to have non-monetary penalties in common law jurisdictions, although they are less common in commercial contracts and legal discussions. These penalties do not involve a direct financial payment but instead require the breaching party to perform a specific action. For instance, a clause might require a party that has breached a confidentiality agreement to issue a public apology or to cease certain business activities.

In either case, the core principle under Indian law remains the same. Whether the penalty is a sum of money or an action, its enforcement depends on whether the court considers it a reasonable consequence for the breach. The goal is always to provide fair compensation to the injured party, not to excessively punish the defaulting party.

Industry-Specific Penalty Clauses

Different industries face unique risks, so it is common to find industry-specific penalty clauses in commercial contracts. These are tailored to address the particular types of breaches that could cause the most harm in that sector. For instance, the potential damages from a delay in a construction project are very different from those in a technology service agreement.

In construction contracts, delays can be incredibly costly, leading to a cascade of problems with subcontractors and materials. Therefore, these agreements often include stringent clauses that impose daily charges for failing to meet project milestones. As seen in the case of Construction & Design Services v. Delhi Development Authority, courts are tasked with determining what constitutes reasonable compensation in such disputes.

Here are a couple of industry examples:

Technology & Software: Service Level Agreements (SLAs) often contain penalty clauses that provide service credits or fee reductions if uptime guarantees or support response times are not met.

Manufacturing: Supply agreements may include penalties for failing to meet quality standards or delivery schedules, protecting the buyer from production line disruptions.

Conclusion

In conclusion, understanding the penalty clause in contract law is essential for all parties involved in a legal agreement. These clauses serve to clarify expectations and consequences, ensuring that both sides are aware of their obligations and the repercussions of defaults. By distinguishing between penalty clauses and liquidated damages, one can navigate their legal implications more effectively, especially considering this particular aspect. Whether you're drafting a new contract or reviewing existing agreements, careful consideration of these clauses will safeguard your interests. If you have any questions or need assistance with your contracts, don’t hesitate to reach out for a consultation.

Frequently Asked Questions

Can parties freely agree on any penalty amount?

No, parties cannot freely agree on any penalty amount. While they can specify a sum in the contract, courts will not enforce it if it is deemed excessive, unreasonable, or against public good and public policy. The Supreme Court in India has repeatedly affirmed that only reasonable compensation can be awarded, regardless of the stipulated penalty amount.

Are penalty clauses in contracts unenforceable?

Penalty clauses in contracts can be unenforceable if they are deemed punitive rather than compensatory. Courts typically assess whether the clause serves a legitimate purpose, such as compensating for actual damages, or if it merely punishes the breaching party. Clarity and reasonableness are essential for enforceability.

What should be considered when drafting a penalty clause?

When drafting what might be considered a penalty clause in commercial contracts, ensure the amount is a genuine pre-estimate of potential losses, including indirect loss. It should be based on providing reasonable compensation rather than punishment. Clearly link the sum to a specific breach of contract to avoid ambiguity and increase the likelihood of it being upheld in court.

About the Company

Volody AI CLM is an Agentic AI-powered Contract Lifecycle Management platform designed to eliminate manual contracting tasks, automate complex workflows, and deliver actionable insights. As a one-stop shop for all contract activities, it covers drafting, collaboration, negotiation, approvals, e-signature, compliance tracking, and renewals. Built with enterprise-grade security and no-code configuration, it meets the needs of the most complex global organizations. Volody AI CLM also includes AI-driven contract review and risk analysis, helping teams detect issues early and optimize terms. Trusted by Fortune 500 companies, high-growth startups, and government entities, it transforms contracts into strategic, data-driven business assets.